Coeur Reports Year-End 2024 Mineral Reserves and Resources and Provides Palmarejo Exploration Update

Coeur Mining, Inc. (“Coeur” or the “Company”) (NYSE: CDE) today reported its 2024 year-end mineral reserves and resources, and provided an update on the 2024 exploration program at its Palmarejo operation. Year-end 2024 proven and probable mineral reserves totaled 3.6 million ounces of gold and 270.5 million ounces of silver, which reflects a 22% year-over-year increase in gold reserves at Kensington and the inclusion of silver and gold ounces from the recently-acquired Las Chispas operation.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250218581271/en/

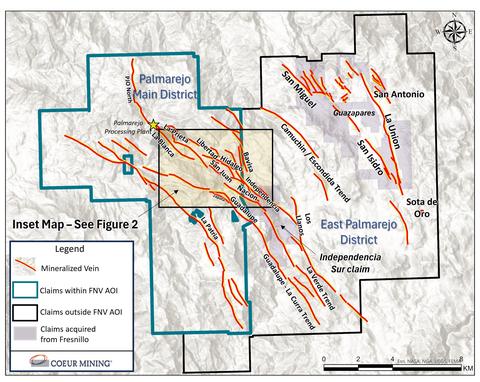

Figure 1: Palmarejo district map (Photo: Business Wire)

Measured and indicated mineral resources totaled 3.7 million ounces of gold, 198.9 million ounces of silver, 1,517 million pounds of zinc and 768.7 million pounds of lead. Gold measured and indicated mineral resources increased 15% year-over-year driven by a 105% increase at Wharf along with increases at Palmarejo, Rochester and Kensington as well as the inclusion of silver and gold ounces at Las Chispas.

Inferred mineral resources were 2.3 million ounces of gold, 106.1 million ounces of silver, 481.8 million pounds of zinc and 199.8 million pounds of lead. Both gold and silver inferred mineral resources increased by 15%, driven by a 216% increase at Wharf and 69% and 84% increases in gold and silver, respectively, at Palmarejo, as well as the inclusion of silver and gold ounces at Las Chispas.

Key Highlights1

- Wharf gold measured and indicated mineral resources more than doubled; gold inferred mineral resources more than tripled – Mine optimization initiatives drove an increase in gold measured and indicated mineral resources by 521,000 ounces and gold inferred mineral resources by 321,000 ounces, positioning Wharf for significant expected mine life extensions as infill drilling accelerates in 2025

- Kensington’s gold proven and probable mineral reserves increased 22% to 500,000 ounces – The nearly-completed multi-year underground development and drilling investment program provides Kensington with greater operational flexibility and a substantially longer mine life, which has doubled since the program commenced in 2022 to the current five years. Kensington’s measured and indicated mineral resources of gold increased over 8% year-over-year

- Second consecutive year of strong resource expansion at Palmarejo – A sustained emphasis on growing the pipeline of silver and gold inferred mineral resources led to an 84% increase in silver inferred mineral resources and a 69% increase in gold inferred mineral resources, which bodes well for future potential mine life extensions

- Expansion drilling at Palmarejo continues to demonstrate growth potential – Expansion drilling in the Hidalgo corridor continues to return positive results directly impacting inferred mineral resources and highlight the excellent potential for future reserve growth. Specifically, the Hidalgo, Libertad and San Juan deposits located immediately northwest of the Independencia deposit were substantially extended and remain open along strike and down dip. Notable estimated true thickness intercepts from the program include:

Libertad deposit

- Hole HGDH_180 returned 14.2 feet at 0.17 ounces per ton (“oz/t”) gold and 13.5 oz/t silver (4.3 meters at 5.7 grams per tonne (“g/t”) gold and 463.3 g/t silver)

- Hole HGDH_181 returned 66.3 feet at 0.06 oz/t gold and 5.9 oz/t silver (20.2 meters at 2.1 g/t gold and 202.4 g/t silver)

- Hole HGDH_182A returned 31.2 feet of 0.08 oz/t gold and 6.6 oz/t silver (10.5 meters at 2.9 g/t gold and 226.2 g/t silver)

- Hole HGDH_189 returned 2.7 feet at 0.83 oz/t gold and 96.8 oz/t silver (0.6 meters at 28.4 g/t gold and 3,320.0 g/t silver)

- Hole HGDH_198 returned 13.1 feet at 0.05 oz/t gold and 11.6 oz/t silver (4.0 meters at 1.6 g/t gold and 396.9 g/t silver)

San Juan deposit

- Hole HGDH_159 returned 1.6 feet at 0.42 oz/t gold and 37.6 oz/t silver (0.5 meters at 14.4 g/t gold and 1,290.0 g/t silver)

- Hole HGDH_162 returned 9.1 feet of 0.03 oz/t gold and 2.7 oz.t silver (2.8 meters at 1.2 g/t gold and 253.3 g/t silver)

- Hole HGDH_169 returned 7.5 feet at 0.01 oz/t gold and 9.3 oz/t silver (2.3 meters at 0.4 g/t gold and 318.3 g/t silver)

“Coeur’s sustained focus on brownfield exploration investment has been incredibly successful and continues to be a key differentiator. Over the past five years, our gold and silver mineral reserves have increased 40% and 48%, respectively, net of depletion, and our gold and silver mineral resources have grown considerably,” said Mitchell J. Krebs, Chairman, President and Chief Executive Officer. “The acquisition of SilverCrest further strengthens the quality of our silver and gold portfolio as evidenced by the 12% increase in our overall reserve grade due to the addition of the high-grade Las Chispas operation.

“At Rochester, the exploration team successfully replaced 2024 production. With a 16-year mine life, the focus remains on drilling higher-grade, near mine targets. Coupled with Kensington’s impressive reserve growth and the substantial resource growth at Wharf, Coeur’s core U.S. operations, where over 70% of our mineral reserves are located, are well-positioned for the future. At Palmarejo in Mexico, the 2024 exploration campaign was also a major success, leading to a 75% increase in its inferred mineral resource base. Overall exploration efforts at Palmarejo continue to trend to the east and outside of the area of the Franco Nevada gold stream, with approximately 60% of total 2025 exploration spending expected in the highly prospective areas in the eastern portion of the Palmarejo district, which we have now fully consolidated.”

Coeur’s gold and silver price assumptions for year-end 2024 reserves were $1,800 per ounce and $23.50 per ounce, respectively, which represented increases over year-end 2023 gold and silver reserve prices of $1,600 per ounce and $21.00 per ounce, respectively. The gold price assumption for reserves at Kensington increased from $1,850 per ounce at year-end 2023 to $2,000 per ounce at year-end 2024.

The Company increased its gold and silver price assumptions for year-end 2024 resources from $1,800 per ounce to $2,100 per ounce and from $25.00 per ounce to $27.00 per ounce, respectively, except at Kensington which gold price assumption increased from $2,000 per ounce to $2,300 per ounce.

For a complete table of all drill results, please refer to the following link: https://www.coeur.com/files/doc_downloads/2025/02/2025-02-18-Exploration-Update-Appendix-Final.pdf. Please see the “Cautionary Statements” section for additional information regarding drill results.

Palmarejo 2024 Exploration Update

Coeur’s 2024 exploration program at Palmarejo focused on step-out and expansion drilling around near-mine veins to build inferred resource ounces and support mine life additions. The program was heavily focused on Hidalgo, Libertad and San Juan deposits which are northwest extensions to Independencia, the East Palmarejo district, and claims to the east and outside of the area encumbered by the Franco Nevada gold stream. Roughly 39% of exploration investment was undertaken outside of the area of interest with plans to increase this to approximately 60% in 2025.

Drilling along the Hidalgo corridor comprising the Hidalgo, Libertad and San Juan veins continued to establish Hidalgo as the second largest source of mineral reserves after Guadalupe with multiple high-grade structures drilled extending the zone by a further 0.4 miles (650 meters) to the northwest towards the Palmarejo processing facility as shown in figure 2.

Near Mine Exploration in Palmarejo Main District

At Libertad, new targets were identified through a geological re-evaluation of existing drill holes and surface data. Follow-up drilling intersected up to 7 individual veins with high-grade splays. The zones show similar widening and narrowing patterns to the Independencia and Guadalupe veins.

Drilling along strike and to the northwest of Libertad continues to encounter favorable host rocks, structures and grades that indicate excellent potential for resource expansion. The total strike length of the Hidalgo complex has been drilled for a total of two miles (three kilometers). A high priority in 2025 is to target areas to the north and west of the current Libertad deposit that have not been previously drilled.

At the San Juan deposit, shown in figure 2, drilling resumed in late 2023 following surface mapping and geological reinterpretation. 24 core holes were drilled during this period and resulted in initial reserves and resources.

Exploration Outside of the Area of Interest

Prospecting and mapping of the Independencia Sur claim (see figure 2), which was recently acquired from Fresnillo and is immediately adjacent to and southeast of the current operation, outlined extensions and parallel veins to those currently being mined. This area is a key focus of the 2025 exploration program, with validation drilling planned and the potential to expand resources near the existing underground infrastructure at the Guadalupe and Nacion deposits.

District work in the area outside the encumbered gold stream accelerated significantly in 2024. Mapping and sampling completed at the San Miguel and La Union veins extended trends by approximately two miles (three kilometers) and six miles (ten kilometers), respectively. Another known vein system, the San Isidro vein, was also extended by five miles (eight kilometers). District exploration of this area is expected to continue in 2025 and beyond.

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing precious metals producer with five wholly-owned operations: the Las Chispas silver-gold mine in Sonora, Mexico, the Palmarejo gold-silver complex in Chihuahua, Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska and the Wharf gold mine in South Dakota. In addition, the Company wholly-owns the Silvertip polymetallic critical minerals exploration project in British Columbia.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding mineral reserve and mineral resource estimated, exploration efforts and plans, growth, mine lives, mine expansion and development plans, and resource delineation, expansion, and upgrade or conversion. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that anticipated additions or upgrades to reserves and resources are not attained, the risk that planned exploration programs may be curtailed or canceled due to budget constraints or other reasons, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold, silver, zinc and lead and a sustained lower price environment, the uncertainties inherent in Coeur’s production, exploratory and developmental activities, including risks relating to permitting and regulatory delays, ground conditions, grade and recovery variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of mineral reserves and mineral resources, the potential effects of pandemics or epidemics, including impacts to the availability of our workforce, continued access to financing sources, government orders that may require temporary suspension of operations at one or more of our sites and effects on our suppliers or the refiners and smelters to whom the Company markets its production, changes that could result from Coeur’s future acquisition of new mining properties or businesses, the loss of any third-party smelter to which Coeur markets its production, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur’s ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur’s most recent reports on Forms 10-K and 10-Q. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

The scientific and technical information concerning our mineral projects in this news release have been reviewed and approved by a “qualified person” under Item 1300 of Regulation S-K under the Securities Exchange Act of 1934, as amended (“SK 1300”), namely our Senior Director, Technical Services, Christopher Pascoe. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and mineral resources for Coeur’s material properties included in this news release, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant factors, please review the Technical Report Summaries for each of the Company’s material properties which are available at www.sec.gov.

Coeur’s public disclosures, including disclosures of mineral reserves and resources, are governed by the U.S. Securities Exchange Act of 1934, including Item 1300 of SEC Regulation S-K. SilverCrest has traditionally disclosed estimates of Las Chispas “measured,” “indicated,” and “inferred” mineral resources as such terms are used in Canada’s National Instrument 43-101. Although Item 1300 of SEC Regulation S-K and NI 43-101 have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, they at times embody different approaches or definitions. Consequently, investors are cautioned that public disclosures by SilverCrest prepared in accordance with NI 43-101 may not be comparable to similar information made public by companies, including Coeur, subject to Item 1300 of SEC Regulation S-K and the other reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder.

Notes

The potential quantity and grade for the deposits described herein are conceptual in nature. There is insufficient exploratory work to define a mineral resource and it is uncertain if further exploration will result in the applicable target being delineated as a mineral resource.

- 2024 reserves and resources were determined in accordance with Item 1300 of SEC Regulation S-K. Reserves and resources for certain prior periods were determined in accordance with Canadian National Instrument 43-101. Both sets of reporting standards have similar goals in terms of conveying an appropriate level of confidence in the disclosures being reported, but the standards embody slightly different approaches and definitions.

- For a complete table of all drill results included in this release, please refer to the following link: https://www.coeur.com/files/doc_downloads/2025/02/2025-02-18-Exploration-Update-Appendix-Final.pdf.

- Rounding of grades, to significant figures, may result in apparent differences.

2024 Year-End Proven and Probable Reserves |

||||||

| Grade | Contained | |||||

| Gold | Silver | Gold | Silver | |||

| Short tons | (oz/t) | (oz/t) | (oz) | (oz) | ||

| PROVEN RESERVES | ||||||

| Las Chispas | 787,000 |

0.150 |

15.99 |

118,000 |

12,586,000 |

|

| Palmarejo | 3,473,000 |

0.059 |

3.94 |

205,000 |

13,667,000 |

|

| Rochester | 468,432,000 |

0.002 |

0.37 |

1,116,000 |

172,408,000 |

|

| Kensington | 1,340,000 |

0.186 |

- |

249,000 |

- |

|

| Wharf | 6,563,000 |

0.030 |

- |

199,000 |

- |

|

| Total | 480,595,000 |

0.004 |

0.41 |

1,887,000 |

198,660,000 |

|

| PROBABLE RESERVES | ||||||

| Las Chispas | 2,700,000 |

0.089 |

7.75 |

239,000 |

20,931,000 |

|

| Palmarejo | 8,373,000 |

0.057 |

3.86 |

475,000 |

32,307,000 |

|

| Rochester | 59,123,000 |

0.003 |

0.32 |

182,000 |

18,632,000 |

|

| Kensington | 1,427,000 |

0.177 |

- |

252,000 |

- |

|

| Wharf | 22,993,000 |

0.024 |

- |

558,000 |

- |

|

| Total | 94,615,000 |

0.018 |

0.76 |

1,706,000 |

71,870,000 |

|

| PROVEN AND PROBABLE RESERVES | ||||||

| Las Chispas | 3,486,000 |

0.102 |

9.61 |

357,000 |

33,516,000 |

|

| Palmarejo | 11,845,000 |

0.057 |

3.88 |

681,000 |

45,974,000 |

|

| Rochester | 527,555,000 |

0.002 |

0.36 |

1,298,000 |

191,040,000 |

|

| Kensington | 2,768,000 |

0.181 |

- |

501,000 |

- |

|

| Wharf | 29,556,000 |

0.026 |

- |

757,000 |

- |

|

| Total | 575,211,000 |

0.006 |

0.47 |

3,593,000 |

270,530,000 |

|

Notes to above Mineral Reserves:

- Certain definitions: The term “reserve” means that part of a mineral deposit that can be economically and legally extracted or produced at the time of the reserve determination. The term “proven (measured) reserves” means reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes, grade and/or quality are computed from the results of detailed sampling; and (b) the sites for inspection, sampling and measurements are spaced so closely and the geologic character is sufficiently defined that size, shape, depth and mineral content of reserves are well established. The term “probable (indicated) reserves” means reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven (measured) reserves, is high enough to assume continuity between points of observation. The term “cutoff grade” means the lowest grade of mineralized material considered economic to process. Cutoff grades vary between deposits depending upon prevailing economic conditions, mineability of the deposit, by-products, amenability of the mineralized material to silver or gold extraction and type of milling or leaching facilities available.

- The Mineral Reserve estimates are current as of December 31, 2024, are reported using the definitions in Item 1300 of Regulation S-K and were prepared by the Company’s technical staff.

- Assumed metal prices for 2024 Mineral Reserves were $23.50 per ounce of silver, $1,800 per ounce of gold, $1.15 per pound of zinc, $0.95 per pound of lead, except for Kensington at $2,000 per ounce of gold.

- Palmarejo Mineral Reserve estimates use the following key input parameters: assumption of conventional longhole underground mining; reported above a variable gold equivalent cut-off grade that ranges from 2.13–2.45 g/t AuEq and an incremental development cut-off grade 1.05 g/t AuEq; metallurgical recovery assumption of 92.0% for gold and 83.0% for silver; mining dilution assumes 0.3–1.5 meter of hanging/foot wall waste dilution; mining loss of 15% was applied; variable mining costs that range from US$57.67–US$74.45/tonne, surface haulage costs of US$4.29/tonne, process costs of US$31.06/tonne, general and administrative costs of US$15.95/tonne, and surface/auxiliary support costs of US$4.42/tonne. Excludes the impact of the Franco-Nevada gold stream agreement at Palmarejo in calculation of Mineral Reserves. No assurances can be given that all mineral reserves will be mined, as mineralized material that may qualify as reserves under applicable standards by virtue of having positive economics may not generate attractive enough returns to be included in our mine plans, due to factors such as the impact of the gold stream at Palmarejo. As a result, we may elect not to mine portions of the mineralized material reported as reserves.

- Rochester Mineral Reserve estimates are tabulated within a confining pit design and use the following input parameters: Rochester oxide variable recovery Au = 77.7–85.9% and Ag = 59.4-61.0%; Rochester sulfide variable recovery Au = 15.2–77.7% and Ag = 0.0–59.4%; with a net smelter return cutoff of $3.76/ton oxide and US$3.86/ton sulfide; Nevada Packard oxide recovery Au = 92.0% and Ag = 61.0%; with a net smelter return cutoff of $4.24/ton for oxide; Lincoln Hill oxide recovery Au = 63.9% and Ag = 39.5%; with a net smelter return cutoff of $4.53/ton for oxide where the NSR is calculated as resource net smelter return (NSR) = silver grade (oz/ton) * silver recovery (%) * (silver price ($/oz) - refining cost ($/oz)) + gold grade (oz/ton) * gold recovery (%) * (gold price ($/oz) - refining cost ($/oz)); variable pit slope angles that approximately average 48º over the life-of-mine.

- Kensington Mineral Reserve estimates use the following key input parameters: assumption of conventional underground mining; gold price of $2,000/oz; reported above a gold cut-off grade of 0.133 oz/ton Au; metallurgical recovery assumption of 94.2%; gold payability of 97.5%; mining dilution of 15-20%; mining loss of 12% was applied; mining costs of US$116.09/ton mined; process costs of US$55.14/ton processed; general and administrative costs of US$53.18/ton processed; sustaining capital US$4.50/ton processed; and concentrate refining and shipping costs of US$97.48/oz sold.

- Wharf Mineral Reserve estimates use the following key input parameters: assumption of conventional open pit mining; reported above a gold cut-off grade of 0.010 oz/ton Au; average metallurgical recovery assumption of 78.0%; royalty burden of US$140.40/oz Au; pit slope angles that vary from 34–50º; mining costs of US$2.56/ton mined, and process costs of US$12.02/ton processed (includes general & administrative and sustaining capital costs).

- Las Chispas Mineral Reserve estimates uses the following key input parameters: assumption of conventional underground mining; reported above a silver cut-off grade of 250 g / tonne silver equivalent and an incremental development cut-off grade of 63 g / tonne AgEq; metallurgical recovery assumption of 97.5% for silver and 98.0% for gold; mining dilution assumes 5% for development, 1 meter to 1.5 meters of ELOS (0.5 m – 1.0 m of hanging wall and 0.25 m – 0.5 m of footwall dilution) depending on geotechnical conditions in each stoping location, 0.2 meter ELOS (0.1 m of hanging wall and 0.1 m of footwall dilution) for cut and fill, 0.4 meter ELOS (0.2 m of hanging wall and 0.2 m of footwall dilution), 0.25 m for each exposed backfill floor, and 0.5 m for each exposed backfill wall; mining loss of 2% for development and 5% for stoping was applied, additional losses have been included to account for the required pillars in uphole stopes that cannot be filled; variable production mining costs that range from US$58.06–US$239.51/tonne, development mining costs of US$27.40/tonne, process costs of US$45.72/tonne, site general and administrative costs of US$20.70/tonne, underground general and administrative costs of US$12.81/tonne, and sustaining capital costs of US$7.64/tonne.

- Rounding of short tons, grades, and troy ounces, as required by reporting guidelines, may result in apparent differences between tons, grades, and contained metal contents.

2024 Year-End Measured and Indicated Resources |

|||||||||

| Grade | Contained | ||||||||

| Gold | Silver | Zinc | Lead | Gold | Silver | Zinc | Lead | ||

| Short tons | (oz/t) | (oz/t) | (%) | (%) | (oz) | (oz) | (lbs) | (lbs) | |

| MEASURED RESOURCES | |||||||||

| Las Chispas | 116,000 |

0.302 |

31.23 |

- |

- |

35,000 |

3,623,000 |

- |

- |

| Palmarejo | 6,996,000 |

0.068 |

4.59 |

- |

- |

474,000 |

32,138,000 |

- |

- |

| Rochester | 82,371,000 |

0.002 |

0.28 |

- |

- |

144,000 |

23,383,000 |

- |

- |

| Kensington | 2,150,000 |

0.254 |

- |

- |

- |

546,000 |

- |

- |

- |

| Wharf | 10,180,000 |

0.017 |

- |

- |

- |

175,000 |

- |

- |

- |

| Silvertip | 734,000 |

- |

10.56 |

9.93% |

7.88% |

- |

7,749,000 |

145,703,000 |

115,648,000 |

| Total | 102,547,000 |

0.013 |

0.65 |

1,374,000 |

66,894,000 |

145,703,000 |

115,648,000 |

||

| INDICATED RESOURCES | |||||||||

| Las Chispas | 1,094,000 |

0.110 |

9.87 |

- |

- |

120,000 |

10,798,000 |

- |

- |

| Palmarejo | 15,368,000 |

0.062 |

3.76 |

- |

- |

949,000 |

57,777,000 |

- |

- |

| Rochester | 40,402,000 |

0.003 |

0.34 |

- |

- |

116,000 |

13,541,000 |

- |

- |

| Kensington | 1,450,000 |

0.234 |

- |

- |

- |

340,000 |

- |

- |

- |

| Wharf | 49,155,000 |

0.017 |

- |

- |

- |

845,000 |

- |

- |

- |

| Silvertip | 6,418,000 |

- |

7.78 |

10.68% |

5.09% |

- |

49,919,000 |

1,371,074,000 |

653,008,000 |

| Total | 113,887,000 |

0.021 |

1.16 |

2,370,000 |

132,035,000 |

1,371,074,000 |

653,008,000 |

||

| MEASURED AND INDICATED RESOURCES | |||||||||

| Las Chispas | 1,211,000 |

0.129 |

11.91 |

- |

- |

156,000 |

14,421,000 |

- |

- |

| Palmarejo | 22,363,000 |

0.064 |

4.02 |

- |

- |

1,423,000 |

89,915,000 |

- |

- |

| Rochester | 122,773,000 |

0.002 |

0.30 |

- |

- |

260,000 |

36,924,000 |

- |

- |

| Kensington | 3,600,000 |

0.246 |

- |

- |

- |

886,000 |

- |

- |

- |

| Wharf | 59,335,000 |

0.017 |

- |

- |

- |

1,019,000 |

- |

- |

- |

| Silvertip | 7,152,000 |

- |

8.06 |

10.60% |

5.37% |

- |

57,668,000 |

1,516,777,000 |

768,657,000 |

| Total | 216,434,000 |

0.017 |

0.92 |

3,744,000 |

198,929,000 |

1,516,777,000 |

768,657,000 |

||

2024 Year-End Inferred Resources |

|||||||||

| Grade | Contained | ||||||||

| Gold | Silver | Zinc | Lead | Gold | Silver | Zinc | Lead | ||

| Short tons | (oz/t) | (oz/t) | (%) | (%) | (oz) | (oz) | (lbs) | (lbs) | |

| INFERRED RESOURCES | |||||||||

| Las Chispas | 1,276,000 |

0.113 |

7.91 |

- |

- |

144,000 |

10,088,000 |

- |

- |

| Palmarejo | 6,577,000 |

0.098 |

5.28 |

- |

- |

643,000 |

34,748,000 |

- |

- |

| Rochester | 116,521,000 |

0.002 |

0.36 |

- |

- |

258,000 |

41,838,000 |

- |

- |

| Kensington | 993,000 |

0.230 |

- |

- |

- |

228,000 |

- |

- |

- |

| Wharf | 26,735,000 |

0.018 |

- |

- |

- |

470,000 |

- |

- |

- |

| Silvertip | 2,345,000 |

- |

6.86 |

10.27% |

4.26% |

- |

16,084,000 |

481,791,000 |

199,815,000 |

| Wilco | 25,736,000 |

0.021 |

0.13 |

- |

- |

531,000 |

3,346,000 |

- |

- |

| Total | 180,185,000 |

0.013 |

0.46 |

2,273,000 |

106,104,000 |

481,791,000 |

199,815,000 |

||

Notes to above Mineral Resources:

- Certain definitions: The term “resource” means that it is a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quantity that there are reasonable prospects for economic extraction. Inferred, Indicated, and Measured resources are in order of increasing confidence based on level of underlying geological evidence. The term ‘inferred resource’ is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The term “limited geological evidence” means evidence that is only sufficient to establish that geological and grade or quality continuity is more likely than not. The level of geological uncertainty associated an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability and must have a reasonable expectation that the majority of inferred mineral resources could be upgraded to indicated or measured mineral resources with continued exploration. In addition, no assurances can be given that any mineral resource estimate will ultimately be reclassified as proven or probable mineral reserves or that inferred resources will be upgraded to measured or indicated resources.

- Mineral Resource estimates are reported exclusive of mineral reserves, are current as of December 31, 2024, and are reported using definitions in Item 1300 of Regulation S and were prepared by the Company’s technical staff.

- Assumed metal prices for 2024 estimated Mineral Resources were $27.00 per ounce of silver, $2,100 per ounce of gold, $1.30 per pound of zinc, $1.00 per pound of lead, unless otherwise noted.

- Palmarejo Mineral Resource estimates use the following key input parameters: assumption of conventional longhole underground mining; reported above a variable gold equivalent cut-off grade that ranges from 1.83–2.10 g/t AuEq; metallurgical recovery assumption of 92.0% for gold and 83.0% for silver; variable mining costs that range from US$57.67–US$74.45/tonne, surface haulage costs of US$4.29/tonne, process costs of US$31.06/tonne, general and administrative costs of US$15.95/tonne, and surface/auxiliary support costs of US$4.42/tonne. Excludes the impact of the Franco-Nevada gold stream agreement at Palmarejo in calculation of Mineral Resources.

- Kensington Mineral Resource estimates use the following key input parameters: Mineral Resource estimates use the following key input parameters: metal price of $2,300 per ounce gold, assumption of conventional longhole underground mining; reported above a variable gold cut-off grade of 0.115 oz/ton Au; metallurgical recovery assumption of 94.2%; gold payability of 97.5%, mining costs of US$116.09/ton mined; process costs of US$55.14/ton processed; general and administrative costs of US$53.18/ton processed; sustaining capital US$4.50/ton processed; and concentrate refining and shipping costs of US$97.48/oz sold.

- Wharf Mineral Resource estimates use the following key input parameters: assumption of conventional open pit mining; reported above a gold cut-off grade of 0.008 oz/ton Au; average metallurgical recovery assumption of 78.0% across all rock types; royalty burden of US$140.40/oz Au; pit slope angles that vary from 34–50º; mining costs of $2.56/ton mined, and process costs of US$12.02/ton processed (includes general & administrative and sustaining capital costs).

- Rochester Mineral Resource estimates are tabulated within a confining pit shell and use the following input parameters: Rochester oxide variable recovery Au = 77.7–85.9% and Ag = 59.4%; Rochester sulfide variable recovery Au = 15.2–77.7% and Ag = 0.0–59.4%; with a net smelter return cutoff of $3.76/ton oxide and US$3.86/ton sulfide; Nevada Packard oxide recovery Au = 92.0% and Ag = 61.0%; with a net smelter return cutoff of $4.24/ton for oxide; Lincoln Hill oxide recovery Au = 63.9% and Ag = 39.5%; with a net smelter return cutoff of $4.53/ton for oxide, where the NSR is calculated as resource net smelter return (NSR) = silver grade (oz/ton) * silver recovery (%) * (silver price ($/oz) - refining cost ($/oz)) + gold grade (oz/ton) * gold recovery (%) * (gold price ($/oz) - refining cost ($/oz)); variable pit slope angles that approximately average 48º over the life-of-mine.

- Silvertip Underground Mineral Resource estimates are reported using a net smelter return (“NSR”) cutoff of US$130/tonne. Mineral Resources are reported insitu using the following assumptions: The estimates use the following key input parameters: lead recovery of 89-90%, zinc recovery of 82-83% and silver recovery of 83-84%. Lead concentrate grade of 53-54%; zinc concentrate grade of 56-57%; mining costs of US$68.77/tonne; processing costs of US$58.20/tonne and US$46.49/tonne, where the NSR ($/tonne) = tonnes x grade x metal prices x metallurgical recoveries – royalties – TCRCs – transport costs over the life of the mine. 2023 metal prices were used to determine the mineral resource which were $25.00 per ounce of silver, $1.30 per pound of zinc, $1.00 per pound of lead.

- Wilco Open Pit Mineral Resource estimates are reported using an equivalent gold cutoff of 0.20 ounces per ton assuming a silver to gold ratio of 60:1. Resources are reported in-situ and contained withed a conceptual measured, indicated and inferred optimized pit shell. Silver price of US$20/oz, gold price of US$1,400/oz. Average oxide and sulfide gold recovery is 70%, average carbonaceous gold recovery is 50%. Average oxide and sulfide gold recovery is 60%. Average carbonaceous silver recovery is 50%. Open pit mining cost is US$1.50/ton, processing and processing and general and administrative cost is US$5.46/ton; average pit slope angles of 50º. The technical and economic parameters are those that were used in the 2018 Resource Estimation. Based on the QPs review of the estimate, there would be no material change to the mineral resources if a gold price of US$1,700/oz, a silver price of US$22/oz or economic parameters were updated. Therefore the 2018 Mineral Resource report is considered current and is presented unchanged.

- Las Chispas Mineral Resource estimates uses the following key input parameters: assumption of conventional underground mining; reported above a silver cut-off grade of 205 g / tonne silver equivalent and an incremental development cut-off grade of 54 g / tonne AgEq; metallurgical recovery assumption of 97.5% for silver and 98.0% for gold; mining loss of 2% for development and 5% for stoping was applied, additional losses have been included to account for the required pillars in uphole stopes that cannot be filled; variable production mining costs that range from US$58.06–US$239.51/t, development mining costs of US$27.40/t, process costs of US$45.72/t, site general and administrative costs of US$20.70/t, underground general and administrative costs of US$12.81/t, and sustaining capital costs of US$7.64/t.

- Rounding of short tons, grades, and troy ounces, as required by reporting guidelines, may result in apparent differences between tons, grades, and contained metal contents.

Conversion Table |

||

1 short ton |

= |

0.907185 metric tons |

1 troy ounce |

= |

31.10348 grams |

View source version on businesswire.com: https://www.businesswire.com/news/home/20250218581271/en/

Contact

For Additional Information

Coeur Mining, Inc.

200 S. Wacker Drive, Suite 2100

Chicago, Illinois 60606

Attention: Jeff Wilhoit, Senior Director, Investor Relations

Phone: (312) 489-5800

www.coeur.com