MAC Copper Announces June 2025 Quarterly Report

MAC Copper Limited ARBN 671 963 198 (NYSE: MTAL; ASX:MAC)

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250723365726/en/

Figure 1 - CSA Copper Mine Recordable Injuries by Quarter

MAC Copper Limited (NYSE: MTAL; ASX: MAC), a private limited company incorporated under the laws of Jersey, Channel Islands (“MAC” or the “Company”) is pleased to release its June 2025 quarterly activities report (“Q2 2025” or “June quarter”).

HIGHLIGHTS

Material improvement in safety performance

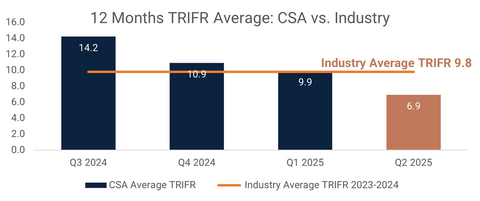

- Decrease in TRIFR to 6.9 in Q2 2025 from a TRIFR of 9.9 recorded in Q1 2025 and a TRIFR of 10.9 in Q4 2024

- MAC continues to embed its culture of heightened awareness and focus on safety against the backdrop of a material transaction

Strong quarterly production of 10,587 tonnes at an improved 4.4% Cu grade

- 10,587 tonnes of copper produced in Q2 2025, representing an increase of ~23% quarter on quarter (“QoQ”)

- Record daily production achieved under MAC ownership of 385 tonnes in June 2025

- 4.4% Cu grade achieved, representing an increase of ~8% QoQ

- C1 of US$1.48/lb2 represented a decrease of ~23% QoQ. Lower C1 costs was mainly driven by the increase in production volume during the quarter and represents a record low quarterly C1 under MAC ownership

- Total Cash Costs2 of US$2.17/lb represented a decrease of ~12% QoQ, with the increase in production volume partially offset by higher capital expenditure

- C1 of US$0.94/lb for the month of June 2025 with ~5,556 tonnes of copper produced at a grade of 6.2% Cu

- July 2025 month to date production of 4,530 tonnes of copper at a grade of 7.41% with the total month of July 2025 production estimated to be in the range of 5,900 to 6,200 tonnes of copper3

- Copper production guidance for 2025 maintained at between 43,000 to 48,000 tonnes

- The CSA Copper Mine continues to demonstrate its high-grade low-cost nature in a Tier 1 jurisdiction

Increased balance sheet strength

- Operational FCF of ~US$42 million for the quarter, a record under MAC ownership, and an increase of ~71% QoQ

- Cash and cash equivalents of ~US$102 million (~A$156 million)4, representing an increase of 36% QoQ

- Liquidity of ~US$196.1 million (~A$299.4 million) 3 which includes ~US$11.1 million of outstanding Quotational Period (“QP”) receipts, ~US$18.5 million of unsold concentrate and Polymetals investment of US$5.5 million

- Unsold concentrate as at 21 July 2025 amounted to an estimated of ~US$59 million5

- A revised Rehabilitation Cost Estimate (“RCE”) submitted to the NSW Regulator resulted in a reduction of ~A$4 million in the RCE as progressive rehabilitation continues

Glencore contingent consideration

- Based on the average daily LME closing price of copper for the 18-month period leading up to the end of June 2025, the condition of the first contingent payment of US$75 million to Glencore is likely to be satisfied in or around August 2025

- The full form documentation continues to recognise that the contingent is not payable before 16 June 2026, other than from free cashflow and after satisfaction of all operating costs and debt servicing

Targeting copper production of >50ktpa by 2026

- Underground capital development of 1,196 metres for the quarter (~390% increase QoQ), a record under MAC ownership

- Merrin Mine – 513m of development completed in Q2 2025 – Polymetals recommissioned its Endeavour concentrator during the month, thus providing a processing pathway for the Merrin zinc ore

- Ventilation project – 564m of development completed in Q2 2025, progressing in line with plan

- Growth capital of ~US$10.7 million for Q2 2025 with ramp up of projects underway with capital expenditure guidance maintained

MAC Copper Limited’s CEO, Mick McMullen, said:

“Our team has again built on the positive momentum achieved on safety with a further reduction in not only the total incidents recorded, but also the severity of these incidents during the quarter with TRIFR reducing to 6.9, down from 9.9 recorded at the end of Q1 2025. This is a remarkable effort considering the disruptive impact the Harmony Transaction had on site in the lead up to and immediately after announcement and I want to thank all of our people for continuing to focus on the job at hand throughout this period.

This material improvement in safety represents a shift in our safety culture through the heightened awareness and focus of our people benefiting from extensive training and coaching. There is nothing more important than the health and well-being of our people, and the communities we are proud to be a part of.

As noted in previous announcements, copper production is driven by a small number of large-tonnage, high-grade stopes and the timing of when these are sequenced in the year. As a result of mining these high-grade stopes during the quarter, copper production increased by circa 23% to 10,587 tonnes at an average grade of 4.4% Cu, with this higher-grade stope accessed in the latter part of March and will continue across July 2025. During the quarter, the operations again performed at record levels under MAC’s ownership, including a record-breaking 385 tonnes of copper produced in one day. There is no change to our production guidance previously released on 24 February 2025.

Our C1 for the June 2025 quarter decreased by circa 23% following the increase in copper production, with the C1 for the month of June 2025 also setting a new record low of US$0.94/lb under MAC ownership with around 5,556 tonnes of copper being produced in the month, at a grade of 6.2%, again showcasing the low-cost nature of the CSA Copper mine.

We made great progress on delivering on our growth strategy by targeting a further increase of ~23% to over 50,000 tonnes of copper equivalent production per annum by 2026 compared to 2024, supported by our two key growth projects which include the expansion of the mine to include the new Merrin Mine and bringing the Capital Vent project online by Q4 2025 and Q3 2026 respectively. We completed a record 1,196 metres of underground development for the quarter, a circa 390% increase from the previous quarter and another record under MAC ownership. Over 42% of the capital development for the quarter related to the Merrin Mine which has the ability to impact our production in the near term and which has accelerated with the additional equipment and people being assigned to this area.

We further strengthened our balance sheet on the back of the successful amendment to our debt facilities at the end of Q1 2025. We ended the second quarter with circa US$102 million in cash which represents a 36% increase QoQ, primarily driven by the 71% increase in free cash flow from operations for the quarter.

The teams are working tirelessly on the Harmony Transaction to progress the conditions precedent towards closing as announced on 22 July 2025 with further updates to come as we keep the market updated accordingly. The Transaction presents a great outcome for all stakeholders in the CSA Copper Mine, who will benefit from the stewardship of a well-respected and high-quality operator in Harmony. Alongside my fellow directors, I have no hesitation in supporting the Transaction, in the absence of a superior proposal.”

UPDATE ON RECOMMENDED TRANSACTION WITH HARMONY

As announced by MAC on 27 May 2025, MAC entered into a binding implementation deed with Harmony Gold Mining Company Limited (JSE:HAR, NYSE:HMY) (Harmony) and Harmony Gold (Australia) Pty Ltd (Harmony Australia) (a wholly owned subsidiary of Harmony), under which it is proposed that Harmony Australia will acquire 100% of the issued share capital in MAC by way of a Jersey law scheme of arrangement pursuant to Article 125 of the Companies (Jersey) Law 1991 (the Scheme) (the Transaction).

The Transaction is conditional, among other things, on MAC obtaining from each counterparty to the Silver Stream, the Copper Stream, the Royalty Deed and the Intercreditor Deed all necessary consents, approvals, amendments, exemptions or waivers in respect of the Transaction (in a form and subject to such conditions which are satisfactory to Harmony (acting reasonably) (the Consents Condition).

MAC and Harmony have agreed that the Consents Condition will be taken to be satisfied when:

- various restructuring documents with Harmony, OR Royalties Limited (formerly Osisko Bermuda Limited) (OR Royalties) (in relation to the Copper Stream and the Silver Stream) and Glencore (in relation to the Royalty Deed) (the Restructuring Documents) have been executed by each of the parties to those documents; and

- certain specified conditions precedent to one of the Restructuring Documents, being a restructure deed between MAC, Harmony, OR Royalties, CSA Jersey Limited (a newly incorporated wholly-owned subsidiary of MAC), MAC Australia and CMPL, are satisfied or waived by OR Royalties (the Streams Restructure Deed).

As disclosed on 22 July 2025, MAC has entered into the Restructuring Documents with Harmony, OR Royalties and Glencore (as applicable) pursuant to which the parties have agreed to amend various documents in connection with the Copper Stream, the Silver Stream and the Royalty Deed, with such amendments to take effect after the Scheme has been implemented.

Following the execution of the Restructuring Documents, the only steps required to satisfy the Consents Condition, are for the specified conditions precedent to the Streams Restructure Deed to be satisfied or waived. These conditions include:

- the delivery of customary certificates, legal opinions and other ancillary documents to OR Royalties;

- no event of default or trigger event occurring under the Silver Stream or Copper Stream before the date that is two Business Days before the Court Sanction Hearing; and

- the form of the deed of release in respect of the Senior Debt being agreed by all parties to that deed, Harmony and OR Royalties.

In addition to the above matters, the Transaction remains subject to the following material conditions:

- MAC Shareholders approving the Scheme by a resolution of a majority in number of MAC Shareholders representing 75% or more of the voting rights of the MAC Shares voted by those MAC Shareholders who (being entitled to do so) voted in person or by proxy at the Scheme Meeting;

- MAC shareholders approving certain other matters in connection with the Transaction, at a General Meeting convened contemporaneously with the Scheme Meeting;

- the Scheme being sanctioned by the Royal Court of Jersey (the Court);

- Harmony obtaining approval from Australia’s Foreign Investment Review Board; and

- Harmony obtaining approval from the South African Reserve Bank.

In relation to the regulatory approvals required in connection with the Transaction, Harmony (with the assistance of MAC) has submitted applications to the Australian Foreign Investment Review Board (on behalf of the Australian Federal Treasurer) and the South African Reserve Bank to obtain the requisite regulatory approvals.

A date of 30 July 2025 at 10:00 am (Jersey time) has been scheduled with the Court to hold a directions hearing in relation to the Scheme (the First Court Hearing).

The purpose of the First Court Hearing is to obtain an order from the Court to, among other things, dispatch the Scheme Circular and convene the Scheme Meeting and General Meeting.

Subject to the Court’s order, MAC anticipates the indicative timetable for the next steps of the Transaction to be as follows:

Event |

Date and Time (Jersey time)6 |

Voting record date for Scheme Meeting and General Meeting7 |

4:00 pm (New York time) on Tuesday, 29 July for Scheme Shareholders and MAC Shareholders (as applicable) 7:00 pm (Sydney time) on Tuesday, 29 July for MAC CDI Holders |

Dispatch of Scheme Circular |

Monday, 4 August 2025 |

Latest time for lodging CDI voting instruction forms for Scheme Meeting and General Meeting |

12:30 pm (Jersey time) / 7:30 am (New York time) / 9:30 pm (Sydney time) on Tuesday, 26 August 2025 |

Latest time for lodging proxy forms for Scheme Meeting and General Meeting |

12:30 pm (Jersey time) / 7:30 am (New York time) / 9:30 pm (Sydney time) on Wednesday, 27 August 2025 |

Scheme Meeting |

12:30 pm (Jersey time) / 7:30 am (New York time) / 9:30 pm (Sydney time) on Friday, 29 August 2025 |

General Meeting |

1:00 pm (Jersey time) / 8:00 am (New York time) / 10:00 pm (Sydney time) on Friday, 29 August 2025 (or as soon thereafter as the Scheme Meeting has concluded or been adjourned) |

The MAC board continues to unanimously recommend that MAC shareholders vote in favour of the Scheme, in the absence of a Superior Proposal (as defined in the Implementation Deed). Each of MAC’s directors (who together hold or control 2.4% of MAC’s total current fully paid ordinary shares and CDIs on issue) also intend to vote their MAC shares in favour of the Scheme, subject to the same qualification.

Following the conclusion of the First Court Hearing, MAC will provide a further update in respect of the Transaction by public announcement filed with, or furnished to, the SEC and the ASX.

ESG UPDATE

Safety

Achieved a Total Recordable Injury Frequency Rate (TRIFR) of 6.9 in Q2 2025, a material improvement from an average TRIFR of 9.9 in Q1 2025 and a TRIFR of 14.2 for 2024. The positive momentum that started towards the end of 2024 has been maintained, with both the total number of incidents recorded and the severity of these incidents further reducing during the quarter.

Figure 1 - CSA Copper Mine Recordable Injuries by Quarter8

Sustainability Report

MAC recognizes the importance of our environmental, social and governance responsibilities and that sustainability strategies more broadly are integral to the way we operate and essential to the accomplishment of our goals. During the quarter, in preparation for the 2026 reporting in compliance with AASB S2, MAC undertook a Climate Risk Assessment to identify and quantify our climate related risks and opportunities. This risk assessment is the basis for the AASB S2 Climate related disclosures, which require mandatory reporting for MAC in 2026.

Community

MAC donated A$100,000 to the local Cobar Shire Council’s, the Museum’s Coach House and Underground Mining Experience project which has also been funded through two New South Wales Government programs. The aim of the project is to increase visitation, expenditure and extend the length of stay for visitors to regional New South Wales. In addition to the donation, MAC also contributed underground video footage taken at the CSA Mine which will be used in the museum’s underground experience. MAC believes it is important to invest in the local community in which it operates.

Regulatory

The CSA Forward Plan was updated and submitted to the NSW Resources Regulator along with a revised RCE. The revised RCE resulted in a reduction of ~A$4 million, which was mostly for works which have been completed on the current Southern Tailings Facility. A rehabilitation risk assessment was undertaken as part of the compliance requirements with the NSW Resources Regulator and to inform MAC of rehabilitation risks and requirements. There have been no reportable environmental incidents during the quarter.

Construction activities on the Stage 10 embankment raise have been ongoing with works on the foundation and development on the East Mound continuing during the June Quarter. The majority of the West Mound has been raised to Stage 10. A key trench has been completed and backfilled on the northern half of the mound with a large portion of the northern half raised. The Stage 10 TSF embankment provides TSF capacity out to 2030 and is one of the three main capital projects being undertaken in 2025.

PRODUCTION AND COST SUMMARY

Table 1 – Production and cost summary (unaudited)

Units |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

QoQ

|

|

Copper Production |

Tonnes |

10,864 |

10,159 |

11,320 |

8,644 |

10,587 |

23% |

Sustaining capital |

US$ million |

$12.8 |

$12.5 |

$12.4 |

$7.2 |

$10.4 |

44% |

Growth |

US$ million |

$1.1 |

$0.6 |

$4.1 |

$4.1 |

$10.7 |

161% |

Exploration |

US$ million |

$2.1 |

$2.1 |

$1.0 |

$1.2 |

$2.0 |

67% |

Cash cost (C1)9 |

US$/lb |

$2.0210 |

$1.90 |

$1.66 |

$1.91 |

$1.48 |

(23%) |

Total cash cost11 |

US$/lb |

$2.72 |

$2.71 |

$2.31 |

$2.47 |

$2.17 |

(12%) |

Group Net Debt12 |

US$ million |

$232 |

$232 |

$132 |

$150 |

$123 |

(18%) |

Table 2 - Quarterly Operational Performance of the CSA Copper Mine (unaudited)

CSA Copper Mine Metrics (unaudited) |

Units |

Q2 2024 |

Q3 2024 |

Q4 2024 |

Q1 2025 |

Q2 2025 |

QoQ %

|

U/g development – Capital (ex Merrin Mine) |

Metres |

449 |

735 |

464 |

468 |

683 |

46% |

U/g development – Operating |

Metres |

611 |

359 |

449 |

404 |

148 |

(63%) |

Rehab |

Metres |

113 |

145 |

246 |

412 |

181 |

(56%) |

Total development |

Metres |

1,173 |

1,239 |

1,159 |

1,283 |

1,011 |

(21%) |

Merrin Mine – Capital |

Metres |

- |

- |

- |

227 |

513 |

126% |

Ore Mined |

Tonnes |

271,469 |

238,937 |

285,613 |

214,443 |

250,401 |

17% |

Tonnes Milled |

Tonnes |

266,936 |

260,953 |

284,490 |

214,678 |

242,487 |

13% |

Copper grade processed |

% |

4.2% |

4.0% |

4.1% |

4.1% |

4.4% |

8% |

Copper Recovery |

% |

97.9% |

97.2% |

97.9% |

98.2% |

98.5% |

0% |

Copper Produced |

Tonnes |

10,864 |

10,159 |

11,320 |

8,644 |

10,587 |

23 % |

Silver Produced |

Ounces |

134,072 |

112,299 |

114,019 |

111,383 |

125,478 |

13% |

Copper Sold |

Tonnes |

12,984 |

10,244 |

8,987 |

7,400 |

9,975 |

35% |

Achieved Copper price13 |

US$/lb |

4.41 |

4.18 |

4.18 |

4.27 |

4.36 |

2% |

Achieved Copper price (including hedging) |

US$/lb |

4.24 |

4.04 |

4.02 |

4.04 |

4.16 |

3% |

Mining Cost |

US$/t Mined |

$91.9 |

$85.9 |

$75.2 |

$92.4 |

$75.8 |

(18%) |

Processing Cost |

US$/t Milled |

$31.9 |

$26.3 |

$25.7 |

$37.4 |

$32.9 |

(12%) |

G+A Cost |

US$/t Milled |

$25.6 |

$27.5 |

$24.9 |

$35.3 |

$31.1 |

(12%) |

Total Operating Cost |

US$/t milled |

$149.3 |

$139.6 |

$125.8 |

$165.1 |

$139.7 |

(15%) |

Development Cost |

US$/metre |

$9,330 |

$12,825 |

$12,633 |

$10,933 |

$13,043 |

19% |

Sustaining Capital Expenditure14 |

US$ million |

$12.8 |

$12.5 |

$12.4 |

$7.2 |

$10.4 |

44% |

Tonnes Milled per employee |

t/employee |

186 |

174 |

191 |

148 |

173 |

17% |

Mining |

US$/lb prod |

1.04 |

0.92 |

0.86 |

1.04 |

0.81 |

(22%) |

Processing |

US$/lb prod |

0.36 |

0.31 |

0.29 |

0.42 |

0.34 |

(19%) |

General and Admin |

US$/lb prod |

0.28 |

0.32 |

0.28 |

0.40 |

0.32 |

(19%) |

Treatment and refining |

US$/lb prod |

0.26 |

0.23 |

0.19 |

0.06 |

0.06 |

14% |

Work in Progress inventory |

US$/lb prod |

0.03 |

0.02 |

0.00 |

0.01 |

(0.05) |

(458%) |

Freight and other costs |

US$/lb prod |

0.21 |

0.24 |

0.15 |

0.12 |

0.16 |

30% |

Silver Credits |

US$/lb prod |

(0.16) |

(0.14) |

(0.11) |

(0.14) |

(0.17) |

22% |

C1 Cash Cost |

US$/lb prod |

2.0215 |

1.90 |

1.66 |

1.91 |

1.48 |

(23%) |

Leases |

US$/lb prod |

0.07 |

0.07 |

0.06 |

0.08 |

0.06 |

(18%) |

Inventory WIP |

US$/lb prod |

(0.03) |

(0.02) |

0.00 |

(0.01) |

0.05 |

(458%) |

Royalties |

US$/lb prod |

0.13 |

0.20 |

0.08 |

0.12 |

0.14 |

14% |

Sustaining capital |

US$/lb prod |

0.53 |

0.56 |

0.50 |

0.38 |

0.44 |

18% |

Total Cash Cost |

US$/lb prod |

2.72 |

2.71 |

2.31 |

2.47 |

2.17 |

(12%) |

Total Revenue |

US$ millions |

120.0 |

87.5 |

74.9 |

70.3 |

95.9 |

36% |

Unless stated otherwise all references to dollar or $ are in USD.

Production and C1 costs

Production in Q2 2025 increased by ~23% QoQ , driven by an increase in ore tonnes mined of ~17% QoQ and an increase in processed copper grade of 8% QoQ (~4.4% Cu for Q2 2025). The grade achieved continues to demonstrate the high-quality ore body present at CSA mine. Consistent mining processes have set up the remainder of 2025 with production guidance maintained at a range of between 43,000 to 48,000 tonnes of copper.

Figure 2 - CSA Copper Mine Quarterly Copper Production (tonnes)

The average received copper price was ~2% higher compared with the prior quarter with Q2 2025 at US$4.36/lb, compared to US$4.27/lb for Q1 2025 (excluding hedging impact), with the average spot copper price over the June 2025 quarter at ~US$4.32/lb. Copper hedges at ~US$3,72/lb remain in place to May 2026 with the average copper price after hedging at US$4.16/lb for Q2 2025.

C1 cash costs in Q2 2025 decreased by ~23% QoQ to US$1.48/lb. The increased production tonnes, as detailed above, resulted in a positive impact to C1 of approximately US$0.35/lb.

Figure 3 - CSA Copper Mine C1 Cash Costs16 - US$/lb produced

MAC management continues to implement additional productivity measures to further reduce C1 costs as evident by the declining C1 which has been achieved over the course of the last year (as noted in Figure 3).

Figure 4 provides an illustration of tonnes milled per employee which increased ~17% QoQ which is largely in line with increased ore milled of 13%.

Figure 4 - CSA Mine Tonnes Milled per Employee

Figure 5 - CSA Mine Mining Unit Rate US$/t

Mining unit rates trending down with better cost control initiatives implemented combined with additional tonnes mined. An uplift in ore mined in Q2 2025 compared to the previous quarter is the main driver of the mining unit rate per tonne decreasing by around 18% QoQ.

Figure 6 - CSA Copper Mining Development Costs US$/m

Figure 7 - CSA Copper Mine Capital Development metres

The ~19% increase in cost per development metre related to the ~66% increase in Capital Vent metres completed in Q2 2025 compared to Q1 2025 while the overall development metres remained steady which reduced the overall gross development costs incurred.

Underground capital development of 1,196 metres (~390% increase QoQ), includes 564 metres for Capital Vent project completed during Q1 2025 and 513 metres of capital development in the Merrin Mine. The total development metres in a quarter being a record under MAC ownership.

Processing costs per tonne milled decreased in the June 2025 quarter in line with increased tonnes milled. Tonnes processed for the quarter were 242kt (~13% increase QoQ) at a Cu recovery of 98.5%.

G&A unit rates increased in the current quarter predominately driven by the increase in ore processed.

Figure 8 - CSA Copper Mine Processing Unit Rate US$/t

Figure 9 - CSA Copper Mine Site G+A Unit Rate US$/t

As seen in Figure 10, capital spend (including capitalized development) increased by ~85% over the quarter indicating a significant ramp up in delivering our major capital projects. Capital costs included equipment purchases, diamond drilling and the Stage 10 TSF works. The increase predominately relates ramp up of the Capital Vent project, Merrin mine development combined with purchase or drilling equipment.

Figure 10 - CSA Copper Mine Site Capital US$M

TREASURY UPDATE

Hedging

As part of the initial Debt Facility Agreement to purchase the CSA copper mine, MAC Copper had to implement a hedging program covering the period to June 2026. During the quarter, the Company delivered 3,105 tonnes of copper into this hedge book at a price of US$3.72/lb. A summary of MAC’s open hedge positions as at 30 June 2025 is included below.

Table 3 – Hedge position

|

Copper |

||

|

2025 |

2026 |

Total |

Future Sales (t) |

6,210 |

5,175 |

11,805 |

Future Sales ($/t) |

3.72 |

3.72 |

3.72 |

Cash position, liquidity and debt facilities

The Company’s unaudited cash holding at the end of Q2 2025 was ~US$102 million or ~A$156 million for an unaudited net debt position of ~US$123 million.

There was ~US$28.6 million of cash received for copper concentrate sold to Glencore on 24 June 2025, for which MAC received the cash with revenue to be accounted for early July 2025.

As of 30 June 2025, the pro-forma liquidity was ~US$196 million (~A$299 million), which includes cash of ~US$102 million (A$156 million), US$59 million (A$91 million) undrawn revolving facility, ~US$30 million (A$46 million) of outstanding QP receipts, unsold concentrate and the strategic investment held in Polymetals at a valuation of ~A$9 million (~US$5.5 million) as at 30 June 2025.

Figure 11 – Q2 2025 Cash flow waterfall (US$M)

Contingent consideration for the acquisition of CMPL

Under the terms of the CMPL Share Sale Agreement with Glencore, MAC will become obliged to pay to Glencore:

- a contingent payment of US$75 million if, over the life of the CSA Copper Mine, the average daily London Metal Exchange closing price of copper is greater than US$9,370/t (US$4.25/lb) for any rolling 18‑month period; and

- a contingent payment of US$75 million if, over the life of the CSA Copper Mine, the average daily London Metal Exchange closing price of copper is greater than US$9,920/t (US$4.50/lb) for any rolling 24‑month period.

MAC currently anticipates that, based on the average daily London Metal Exchange closing price of copper for the 18-month period leading up to the end of June 2025, the condition to payment of the first contingent payment of US$75 million to Glencore is likely to be satisfied in or around August 2025.

Under the terms of the CMPL Share Sale Agreement and the Intercreditor Deed, any obligation on MAC to make the contingent payments to Glencore upon satisfaction of the applicable condition is deferred until the earlier of:

- such payment being permitted under the terms of the transaction financing used to fund the acquisition of the CSA Copper Mine on 16 June 2023; and

- the three-year anniversary of MAC’s acquisition of the CSA Copper Mine.

Given the terms of the CMPL Share Sale Agreement and Intercreditor Deed, MAC expects the first contingent payment to become payable by MAC on 17 June 2026, being one business day after the three year anniversary of when MAC originally acquired the CSA Copper Mine.

Given MAC’s current liquidity position, the Company expects to be able to fully cash settle this obligation when it becomes payable.

PROJECTS AND EXPLORATION UPDATE

Pathway to >50,000 tonne per annum of copper equivalent production

The CSA mine is already benefiting from productivity improvements initiated under MAC ownership such as double lift stopes, and operational efficiencies aimed at reducing waste and ensuring efficient delivery of ore.

To further progress towards becoming a 50ktpa+ copper equivalent producer in 2026 and beyond, there are two key projects that are essential to achieve this, being the Ventilation project which is due for completion Q3 2026 and the opening up of the new Merrin Mine with first ore expected in Q4 2025.

The delivery of both these are essential to achieve our strategic goal of uplifting production to over 50,000 tonnes of copper equivalent production by 2026 and unlock the full potential of the CSA copper mine.

Projects updates

Ventilation project update

The Capital Vent Project is designed to support increased mining activity and improving distribution of chilled air to lower mine levels and ensuring operational longevity beyond the current reserve life. The project remains a key enabler for sustained production growth at CSA.

Total spend in Q2 2025 was US$7.3 million, with 564 metres of development being completed, representing a 66% increase on previous quarter. Progress continued establishing access to the first raise bore location, additional geotechnical drilling was completed, and procurement of ventilation fans advanced.

The Company has employed a dedicated Project Manager with extensive underground mine infrastructure experience to have overall control of the project with specific focus on managing the fan chamber excavation and fan installation. This work is a critical time and cost aspect of the project.

Four vendors have pre-qualified to Design, Engineer, Construct & Commission the fan chamber component of the project and tender documents are being finalised. In addition, raise boring contractor negotiations are being finalised.

The project is progressing well, with development successfully integrated into existing operations. It remains on target to be completed by Q3 2026.

Merrin Mine update

Progress continued in developing the Merrin Mine Q2 2025 and a total of 513 metres of capital development was completed which demonstrated that development rates are materially faster (and cheaper) in the Merrin Mine than the existing mining areas with fewer operational constraints.

The new Merrin Mine presents an opportunity for incremental copper and zinc production at the CSA Mine, and is an additional mining area not currently connected to the bottom of the mine which is located ~150m below the surface. Drilling to upgrade this deposit from resource to reserve in some areas has been completed, with ore mining expected to commence by Q4 2025. Drilling continues in the upper remnant sections to provide grade and geotechnical data.

Total capital spend in Q2 2025 was US$3.4 million, primarily allocated to decline development and diamond drilling.

Figure 12 – Merrin Mine

Conceptual mine design for the first stage of the Merrin Mine (Figure 13) has focused on the 2-level to 6-level which will allow for quicker and progressive access to the ore. Conceptual planning of the copper and zinc stopes and related development is completed which supports the commitment for further drilling to raise the resource category in these areas to measured and indicated.

An additional benefit of completing the Merrin Project is the opportunity to replace the existing decline to allow access to significant volumes of sterilised ore. This will also provide the mine with a larger more modern decline suited to larger equipment that will better service the entire mine.

Polymetals recommissioned its Endeavour concentrator during the month providing a processing pathway for the Merrin zinc ore. The Company has an existing toll treatment agreement with Polymetals to treat the Merrin zinc ore at the Endeavour Mill which is 45km to the north of CSA via sealed roads.

Figure 13 – Merrin Mine Preliminary Design

EXPLORATION UPDATE

Fixed-Loop Electromagnetic Survey

During the quarter, MAC completed a Fixed Loop Electromagnetic (FLEM) survey, accompanied with low-temperature Superconducting Quantum Interference Devices (SQUIDs), across the Bundella Project area, located 15 km north of the CSA Mine and 18 km east of the Endeavour Mine (Figure 14). The area shares a lithological and structural setting analogous to the CSA Mine and is considered highly prospective for hosting high-grade Cobar-style deposits.

While modelling is ongoing, the survey has identified a significant late-time electromagnetic displaying key characteristics typical of a Cobar-style deposit (Figure 15 & Figure 16), including:

- A strike extent of approximately 500 metres, oriented NNE

- A vertical extent exceeding 600 metres, with the conductor plate extending to ~940 metres depth (approaching the detection limit)

- A depth to top of ~330 metres below surface

- A conductance of ~2,000 Siemens – consistent with massive sulphide bodies and comparable to conductance used in modelling the CSA ore body

MAC considers the E2C anomaly a high-priority target with all necessary approvals obtained during the quarter and diamond drilling commenced in early July to test the source of the conductor.

Figure 14 – Location of the FLEM survey grid and the E2C anomaly relative to operating assets and infrastructure.

Figure 15 - Modelled FLEM survey data (channel 36) with the prominent E2C anomaly Channel 36 (merged total energy, horizontal gradient resultant image)

Figure 16 – Modelled FLEM conductor, E2C, showing planned diamond drillhole traces.

CONFERENCE CALL DETAILS

The Company will host a conference call and webcast to discuss the Company’s second quarter 2025 results on Wednesday, July 23, 2025 at 7:00 pm (New York time) / Thursday, July 24, 2025 at 9:00 am (Sydney time).

Details for the conference call and webcast are included below.

Webcast

Participants can access the webcast at the following link https://ccmediaframe.com/?id=Wg5kjpd1

Conference Call

Participants can register for the call at https://s1.c-conf.com/diamondpass/10048546-jh7y6t.html

After registering you will receive a confirmation email containing information about joining the conference call and webcast.

Replay

A replay of the webcast will be available via the webcast link above or by visiting the Events section of the Company’s website.

This report is authorised for release by Mick McMullen, CEO & Director.

ABOUT MAC COPPER LIMITED

MAC Copper Limited (NYSE: MTAL; ASX:MAC) is a company focused on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification and decarbonization of the global economy.

Estimates of Mineral Resources and Ore Reserves and Production Target

This release contains estimates of Ore Reserves and Mineral Resources as well as a Production Target. The Ore Reserves, Mineral Resources and Production Target are reported in MAC’s ASX Announcement dated 23 April 2024 titled ‘Updated Resource and Reserve Statement and Production Guidance’ (the R&R Announcement). The Company is not aware of any new information or data that materially affects the information included in the R&R Announcement, and that all material assumptions and technical parameters underpinning the estimates or Ore Reserves and Mineral Resources in the R&R Announcement continue to apply and have not materially changed. The material assumptions underpinning the Production Target in the R&R Announcement continue to apply and have not materially changed. It is a requirement of the ASX Listing Rules that the reporting of ore reserves and mineral resources in Australia comply with the JORC Code. Investors outside Australia should note that while exploration results, mineral resources and ore reserves estimates of MAC in this presentation comply with the JORC Code, they may not comply with the relevant guidelines in other countries and, in particular, do not comply with (i) National Instrument 43-101 (Standards of Disclosure for Mineral Projects) of the Canadian Securities Administrators; or (ii) the requirements adopted by the Securities and Exchange Commission (SEC) in its Subpart 1300 of Regulation S-K. Information contained in this presentation describing mineral deposits may not be comparable to similar information made public by companies subject to the reporting and disclosure requirements of Canadian or US securities laws.

Forward Looking Statements

This release includes “forward-looking statements.” The forward-looking information is based on the Company’s expectations, estimates, projections and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Assumptions have been made by the Company regarding, among other things: the price of copper, continuing commercial production at the CSA Copper Mine without any major disruption, the receipt of required governmental approvals, the accuracy of capital and operating cost estimates, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used by the Company. Although management believes that the assumptions made by the Company and the expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate.

MAC’s actual results may differ from expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward- looking statements. These forward-looking statements include, without limitation, MAC’s expectations with respect to future performance of the CSA Copper Mine. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements. Most of these factors are outside MAC’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the supply and demand for copper; the future price of copper; the timing and amount of estimated future production, costs of production, capital expenditures and requirements for additional capital; cash flow provided by operating activities; unanticipated reclamation expenses; claims and limitations on insurance coverage; the uncertainty in Mineral Resource estimates; the uncertainty in geological, metallurgical and geotechnical studies and opinions; infrastructure risks; and other risks and uncertainties indicated from time to time in MAC’s other filings with the SEC and the ASX. MAC cautions that the foregoing list of factors is not exclusive. MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. MAC does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based.

More information on potential factors that could affect MAC’s or CSA Copper Mine’s financial results is included from time to time in MAC’s public reports filed with the SEC and the ASX. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that MAC does not presently know, or that MAC currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect MAC’s expectations, plans or forecasts of future events and views as of the date of this communication. MAC anticipates that subsequent events and developments will cause its assessments to change. However, while MAC may elect to update these forward-looking statements at some point in the future, MAC specifically disclaims any obligation to do so, except as required by law. These forward-looking statements should not be relied upon as representing MAC’s assessment as of any date subsequent to the date of this communication. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Non-IFRS financial information

MAC’s results are reported under International Financial Reporting Standards (IFRS), noting the results in this report have not been audited or reviewed. This release may also include certain non-IFRS measures including C1, Total Cash costs and Free Cash Flow. These C1, Total Cash cost and Free Cash Flow measures are used internally by management to assess the performance of our business, make decisions on the allocation of our resources and assess operational management. Non-IFRS measures have not been subject to audit or review and should not be considered as an indication of or alternative to an IFRS measure of financial performance.

C1 Cash Cost

C1 costs are defined as the costs incurred to produce copper at an operational level. This includes costs incurred in mining, processing and general and administration as well freight and realisation and selling costs. By-product revenue is credited against these costs to calculate a dollar per pound metric. This metric is used as a measure operational efficiency to illustrate the cost of production per pound of copper produced.

Total Cash Cost

Total cash costs include C1 cash costs plus royalties and sustaining capital less inventory WIP movements. This metric is used as a measure operational efficiency to further illustrate the cost of production per pound of copper produced whilst incurring government-based royalties and capital to sustain operations.

Free Cash Flow

Free cash flow is defined as net cash provided by operating activities less additions to property, plant, equipment and mineral interests. This measure, which is used internally to evaluate our underlying cash generation performance and the ability to repay creditors and return cash to shareholders, provides investors with the ability to evaluate our underlying performance.

| ______________________________________________________ |

1 Under MAC Ownership

2 See “Non-IFRS financial information” and refer to Table 2 for reconciliation of C1 Cash Cost and Total cash cost.

3 Actual July 2025 month to date copper production and forecast July 2025 month copper production as per daily operational report as at 21 July 2025.

4 Converted at USD:AUD exchange rate of 0.655 as at 30 June 2025.

5 Based on the concentrate stocks as at 21 July 2025 as per the operational daily report and applying the closing LME price on 21 July of US$9,666/lb. Represents the Net Realisable Value of the concentrate taking into account transport, refining and royalty charges.

6 All dates and times are based on MAC and Harmony’s current expectations and are subject to change. If any of the dates and/or times in this expected timetable change materially, the revised dates and/or times will be published by a public announcement furnished to the SEC and released to the ASX and by making such announcement available on MAC’s website at www.maccopperlimited.com.

7 Individuals that become MAC Shareholders (or MAC CDI Holders) after this date will not be entitled to vote (or in the case of MAC CDI Holders, will not be entitled to instruct CHESS Depositary Nominees Pty Ltd to vote) at the Scheme Meeting and General Meeting.

8 Industry TRIFR source: Mine Safety performance report 2023-2024, Resource regulator Department of Regional NSW.

9 See “Non-IFRS Information” and refer to Table 2 for reconciliation of C1 Cash Cost and Total Cash Cost.

10 Q2 2024 adjusted post finalisation of the 2024 Half Year accounts with additional freight and TCRCs included accrued for recognition of June pre-sales.

11 Excludes corporate costs from parent entity. See “Non-IFRS financial information” and refer to table 2 for reconciliation of Total Cash Cost.

12 Senior Debt (plus) Drawn Revolving Facility (minus) Cash and cash equivalents (excluding streams).

13 Realised provisional sales price excluding hedging impact.

14 Sustaining capex only.

15 Q2 2024 adjusted post finalisation of the 2024 Half Year accounts with additional freight and TCRCs included accrued for recognition of June pre-sales.

16 See “Non-IFRS Information” and refer to table 2 for reconciliation of C1 Cash Cost.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250723365726/en/

Contact

Mick McMullen

Chief Executive Officer

MAC Copper Limited

investors@metalsacqcorp.com

Morné Engelbrecht

Chief Financial Officer

MAC Copper Limited